Nursing Home Closures

A recent article in the Boston Globe highlighted the difficulties associated with nursing home closures for residents, families and advocates. Within the long-term care sector, and the skilled nursing center sector in particular, this trend has been a slow-motion collision with the inevitable. What’s at work here, and I and others have been going on about for some time are the demographics of aging in the United States, and the age at which consumers access assisted living and skilled nursing.

Ebb tide, not age wave

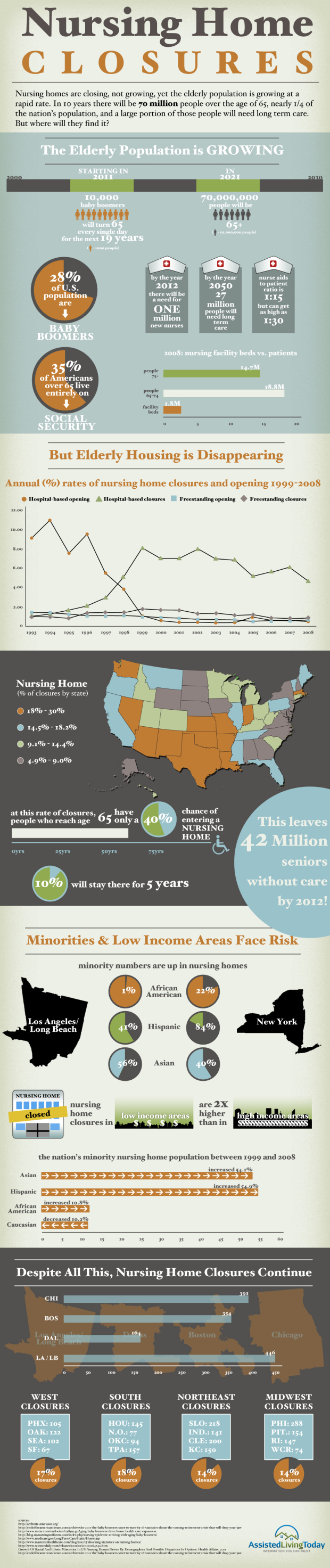

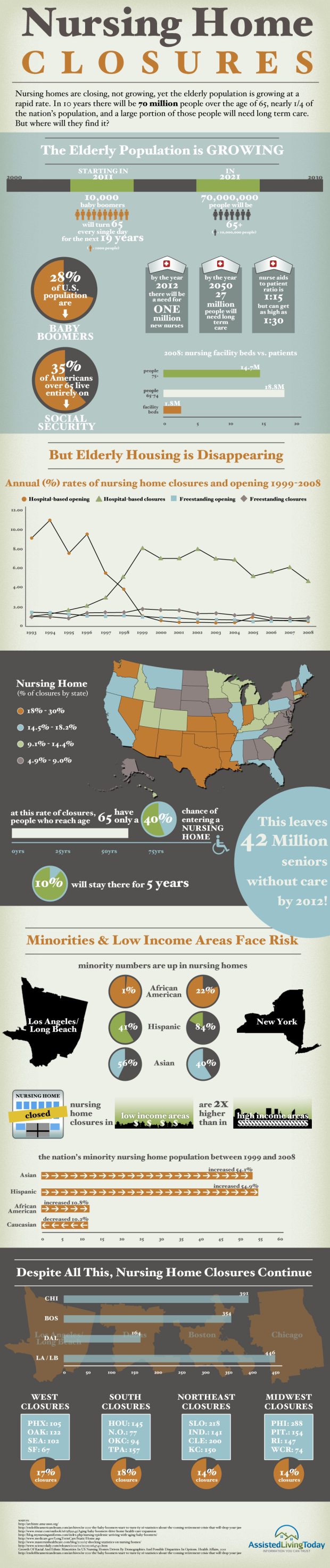

The average age of entrance into skilled nursing is over 87, and the average age for assisted living is slightly over 86. With the exceptions of “young” individuals ages 55 to 75 who are entering skilled nursing centers for very brief periods of rehabilitation and convalescence, the 85+ cohort remains the largest proportion of consumers in the sector. And the size of this population is declining, and will continue to do so for the next 5 to 7 years, perhaps as many as 10.

As the chart of live births in the United States 1900 to 2010 shows, there was a decided decline in live births between 1925 in about 1935. I have labeled this the “demographic dip”, and “birth dearth”. This is the smallest cohort in recorded history within the US, and is also reflected in many other Western nations.

Right sized, or wrong size?

Nursing home closures are the result of several factors, with the overall decline in the market size being the root cause. Certainly we will need more capacity as the LeadingAge baby boom population reaches the age of principle consumption, in approximately 15 to 20 years. Closures, while painful if unanticipated, especially for residents and families, offer planners and businesses an opportunity to revise the inventory and re-examine the model. The largest part of the nursing home inventory hasn’t benefited from any substantial investment for four or five decades. What other sector has been so overlooked? Nursing home owners and operators have been awaiting capital infusions which, with few exceptions, have not materialized. Last time there was a restructuring in the market in the late 1980s, almost 20% of the nursing home beds in the US were owned or managed by companies in receivership. Yet with plenty of low interest rate capital on the sidelines, there have been consolidations in the purchase price per unit for skilled nursing and quality assisted living residences has been steadily rising. How, in the face of declining payments, declining occupancy, and margin pressure will owners of this new, high priced inventory service the debt, improve services and remain afloat?

Slow motion wreck

Whether you consider the current consolidation and contraction in the market simply a “correction” or a consolidation, those of us in the sector must rigorously and rationally examine how best to serve the current population and build a vibrant core within the sector which can respond quickly when demand begins to search. We have the time, do we have the answers? What role does “quality improvement” play in improving outcomes in reducing costs? As an early student of statistical process control and CQI, I have continued to be frustrated that so little of the principles are being adapted in long-term care.

What are your thoughts about how to write size a sector?

Irving Stackpole RRT, MEd is the President of Stackpole & Associates, marketing, market research and training firm at www.StackpoleAssociates.com. He can be reached directly at: istackpole@stackpoleassociates.com.