The on-again, off-again travel restrictions imposed by countries to stop the spread of coronavirus are beginning to look like they’re mostly “gone again” across the world. Except for China and parts of Asia, countries are eagerly removing testing and masking requirements.

The Lesson from Asia

Before the pandemic, China had been a large and growing segment of various travel and tourism markets, as well as medical travel around the world.

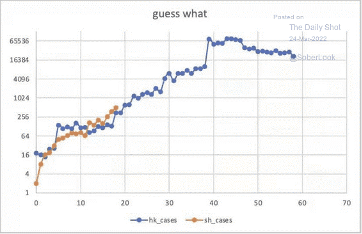

The most recent surges of COVID in Hong Kong and Shanghai are (unfortunately) harbingers of two things:

- Another wave of hospitalizations and deaths, and;

- Further restrictions imposed on travel by Chinese and regional central governments in attempts to stem the contagion.

This will delay the return of travel, and of medical tourism within the region. Even countries with lowered travel restrictions will find fewer travelers because of imposed restrictions. Any anticipated surge from pent up demand over the pandemic will be muted by public health measures restricting travel.

The difficult lesson to be learned is that the removal of travel restrictions themselves does not mean smooth sailing ahead for the travel and tourism, or the health & medical tourism markets.

Fear of Flying: New Realities in Travel

The other factor mitigating against a robust return of travel, and the correlated return of health and medical tourism is the level of personal hesitancy about the risks of travel.

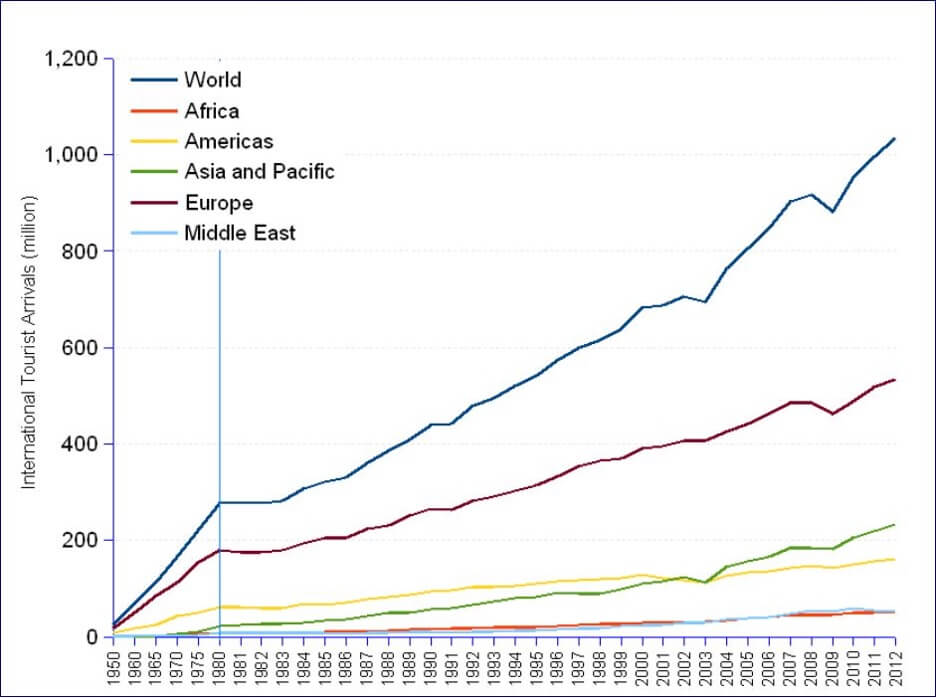

Travel – especially international travel – always carried certain levels of risk. But these risks were gradually better accepted; we can see the robust growth in international travel from 1950.

What the pandemic, and the related media coverage has created is a new realization of risk, and many consumers are not accepting this new reality.

In a recent large scale survey, business travelers who had made at least three business trips per year prior to the pandemic were asked when they thought they would return to traveling as they had before the pandemic.

Concerningly, among most nationalities surveyed 35 – 45% responded “never”! Here is ~40% of seasoned business travellers – so-called road warriors – saying they never expect to return to that level of travel. For travel professionals and those in health medical tourism markets, this insight is disturbing.

Pervasive fear?

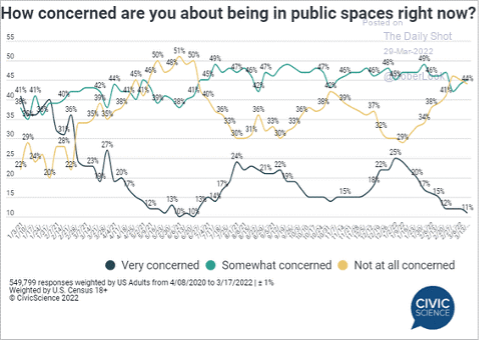

Attempting to measure the “new reality” of travel, we continue to look for signals about fear or worry that consumers have about traveling.

In another large-scale survey of consumers, 56% said they were “very concerned” or “somewhat concerned” about traveling and being in public spaces. On the bright side, 44% were “not at all concerned” and the percent responding “very concerned” have been declining, which offers hope of some travel among these risk-tolerant travellers.

The factor of personal hesitancy to travel (can we call it “fear”?) is a new dimension – at this scale – in global travel.

The Dam Should be Ready to Burst

The dual shocks associated with the pandemic effectively canceled demand (travel restrictions) and severely limited supply (hospitals devoted to Covid). After two years, there is tremendous pent-up demand; people need surgeries and treatments. Meanwhile, many countries which would otherwise be attractive destinations for medical travelers are having healthcare staffing shortages which prevent them from meeting the pent-up demand.

The dual shocks associated with the pandemic effectively canceled demand (travel restrictions) and severely limited supply (hospitals devoted to Covid). After two years, there is tremendous pent-up demand; people need surgeries and treatments. Meanwhile, many countries which would otherwise be attractive destinations for medical travelers are having healthcare staffing shortages which prevent them from meeting the pent-up demand.

This is clearly seen in places like England where over 300,000 procedures that were not done during the two years of pandemic restrictions are clogging up the NHS hospitals, while at the same time there is a major shortage of GPs and nurses.

Where do we go from here?

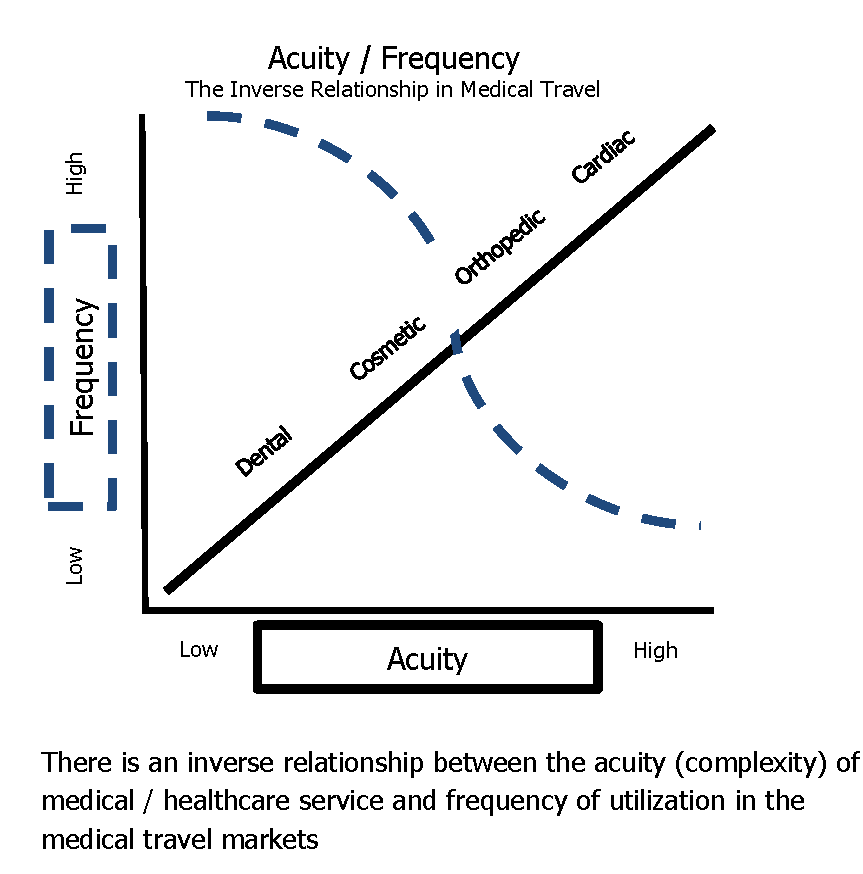

Under ordinary circumstances, a supply/demand mismatch would create markets for, and interest in medical travel to destination locations. No doubt the “fear of flying” inhibits some of this from occurring. However, there are two tiers in the medical tourism market segmentation which can be, and in some cases is being captured by foreign providers. The first segment is consumers in urgent need; the high acuity, low frequency side of the supply/demand model.

These medical travelers were among the first to begin traveling again as early as 2021 and will continue to seek medical care outside of their home countries. In an important sense, their clinical situation makes this segment quite risk tolerant.

The other segment of the medical traveling market that is also risk tolerant are those seeking lifestyle and cosmetic treatments. These are men seeking hair transplants, women seeking facial and body reconstructive procedures as well as those in search of fertility treatments. These motivated consumers are not extremely risk-tolerant but are nevertheless willing to overcome their fear of flying in order to receive of benefits from treatment abroad.

The other segment of the medical traveling market that is also risk tolerant are those seeking lifestyle and cosmetic treatments. These are men seeking hair transplants, women seeking facial and body reconstructive procedures as well as those in search of fertility treatments. These motivated consumers are not extremely risk-tolerant but are nevertheless willing to overcome their fear of flying in order to receive of benefits from treatment abroad.

So the markets on both ends of the supply/demand model are the most fruitful for development. Destinations and providers hoping to attract foreign consumers must consider these factors and develop, test and deliver their messaging carefully.

————————————————————————————————————————–

To explore more dimensions of marketing health & medical tourism, contact Stackpole & Associates at contactus.stackpoleassociates.com. Irving Stackpole can be reached at istackpole@stackpoleassociates.com