Health Tourism: Light at the end of the COVID-19 tunnel

Can we anticipate the likely return of health tourism markets around the globe? Yes. There is light at the end of the COVID-19 tunnel. Understanding that “health tourism” is not a single, monolithic business or industry, but a set of regional vertical markets, the end of COVID-19 shows the fragmentation in health tourism markets.

We are seeing hopeful signs of the end to the dreadful COVID-19 pandemic. The vaccines work against the initial strain and (mostly) the variants, new ones are coming online and, overall, they all have modest side effects. The goal of herd immunity is in sight; for the UK it could be as early as May 2021, in the US June 2021 and in the Euro Zone, because of delays in vaccine access, herd immunity may not be achieved until May 2022.

Because of the complexity of the virus (SARS-CoV-2), its many variants and the uncoordinated public health response between and among countries, it is likely that we will see positivity go up and down for the next 12 to 18 months.

Health Tourism: Segmented return

While herd immunity is the goal, it is not necessarily a requirement for health tourism. The EU, the US and the UK are all pushing forward with plans for vaccination documentation methods that will allow properly documented individuals to travel across borders – an essential requirement in health tourism.

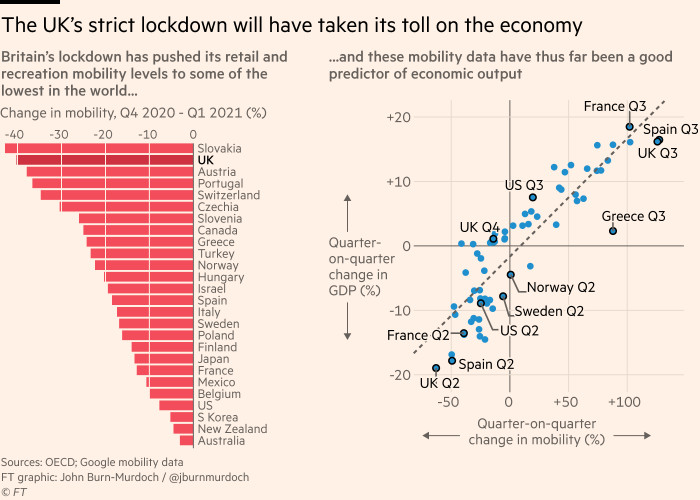

One of the variables that can serve as a proxy for health tourism is mobility. Mobility reflects the effects of travel restrictions, closures and distancing requirements put in place by governments. An interesting comparison recently reported by the Financial Times shows that countries with the most severe mobility restraints (“lockdowns”) also had the deepest economic consequence. The lowest change in mobility from the fourth quarter of 2020 (Q4 2020) to the first quarter of 2021(Q1 2021) was in countries with robust and effective public health controls (Australia, New Zealand and Korea South Korea). Unless they stumble, these countries will also see the most sure-footed economic recovery and the return of health tourism.

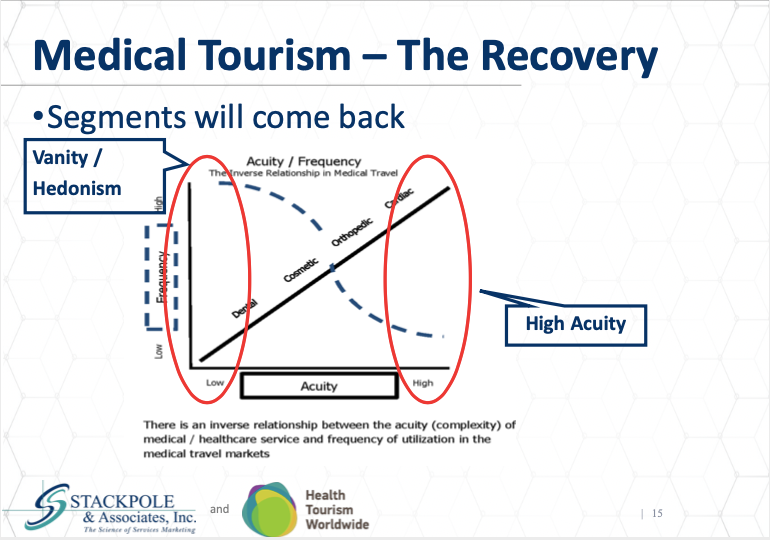

There are already strong anecdotal signs that demand for cross-border and intra-national health and wellness services is surging. Pent up demand in certain regional channels for cosmetic procedures is overwhelming some providers’ ability to keep up.

Wherever they are able to do so, risk tolerant consumers are traveling for hair transplants, cosmetic augmentation procedures and fertility treatments. At the height of the pandemic lockdowns, Laszlo Puczko and I predicted that these market segments would be the first to recover, and this is the case. (You can access this Webinar from January 2021 here: http://bit.ly/3sJqVBW

Medical Services Exports: Medical tourism

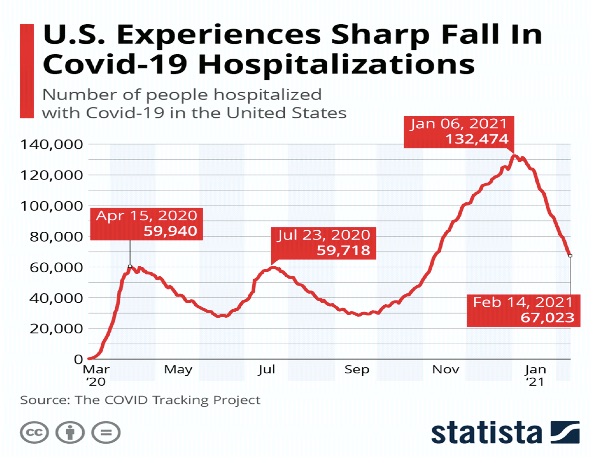

Hospitalizations are declining in the US and UK in particular, and in most of the Euro Zone as well, which means that capacity in the medical tourism markets can begin to recover. Hospitals and doctors may now be able to book hospital operating rooms for elective procedures, whereas during the height of the pandemic non-urgent procedures had to be postponed entirely, scheduled infrequently, or done entirely in outpatient or ambulatory centers.

Complex medical procedures are the smallest proportion of the global health tourism market by volume but represent the highest per unit values and garner lots of headlines and attention. Hospitals and doctors in destination markets like Korea, Malaysia, Dubai and elsewhere have already begun to schedule, promote and perform complex orthopedic, oncological and cardiovascular procedures – always applying rigorous infection control and public health standards. In the US, UK and EZ situation is quite different. The US and the UK providers systems are still struggling to recover from the prolonged and intense demand shocks they experienced. The physical facilities may become available, but many doctors and nurses are burned out. Moreover, global news coverage of hospitals struggling with capacity challenges may have damaged these international brands.

The picture in the Euro Zone is much more fragmented. Germany, for example, which had been praised for its health and medical services response to the surging COVID-19 demand in the spring of 2020 is now undergoing a third, highly challenging wave. Spain, on the other hand which had endured extraordinarily negative press 12 months ago, appears to be recovering quite well, and hospitals there are beginning to see a return of medical travelers.

Putting the Pieces Together

The world remains in a time characterized by a “pandemic economy.” Recovery of health and medical tourism is linked tightly to these cycles. Euromonitor International Recovery Tracker[1] has been watching these effects for global economies and, using 2019 average as a baseline, anticipates a consistent, positive international recovery trend starting sometime in Q2 2021 (optimists say April, realists say June).

The effects of this recovery were discussed in, Health Tourism: The end of COVID-19 is just the beginning.

Click on the link to watch the recording.

[1] Euromonitor International. See: https://blog.euromonitor.com/global-recovery-tracker-long-and-bumpy-road-to-recovery